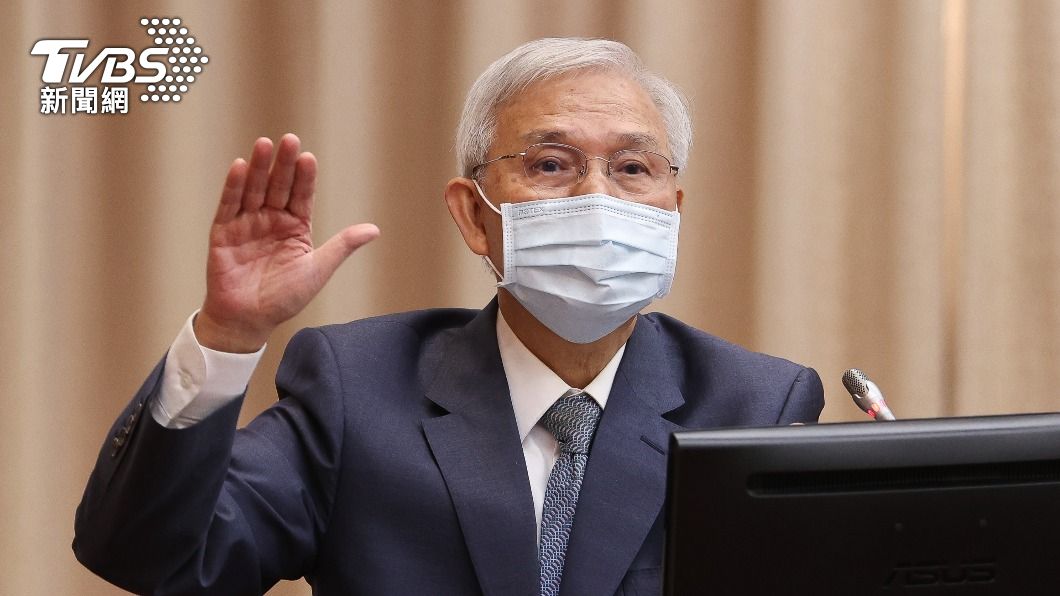

TAIPEI (TVBS News) — A warning was issued on Thursday (March 14) by the Central Bank of the Republic of China's (Taiwan) Governor, Yang Chin-long, regarding the excessive subscriptions for two new ETFs (Exchange-traded funds).

The funds have attracted over NT$100 billion, prompting caution from Yang due to the potential "herding effect."

In response, the Financial Supervisory Commission (FSC) introduced three policy measures.

FSC Chairman Huang Tien-mu is expected to present a special report to the Legislative Yuan on Wednesday (March 20). Market participants are watching intently to see if the report will include new measures to cool off the sizzling ETF investment fervor.

Yang highlighted the inherent risk of boosts and plummets in ETFs under collective investments, warning that "everyone invests together, everyone falls together."

The FSC has also recognized the need for suppressive measures due to the recent enthusiasm for investment in ETFs.

Questions have been raised by the FSC regarding the recent ETF surge. As highlighted by Securities and Futures Bureau Chief Secretary Shang Kuang-chi, the issue of fund concentration exists as ETFs are based on index constituent stocks, potentially leading to overlapping problems.

Another issue lies in investors not having a clear understanding of the nature of individual ETFs, and the disclosure and advertising standards are also under scrutiny.

As the regulation for the surge in ETF investment continues, Shang noted that imposing an upper limit on a single ETF IPO is an option but not the only one.

Consequently, the FSC has made it mandatory for ETFs to stop advertising using annualized dividend rates. In case of infringement, a fine of up to NT$3 million can be imposed.