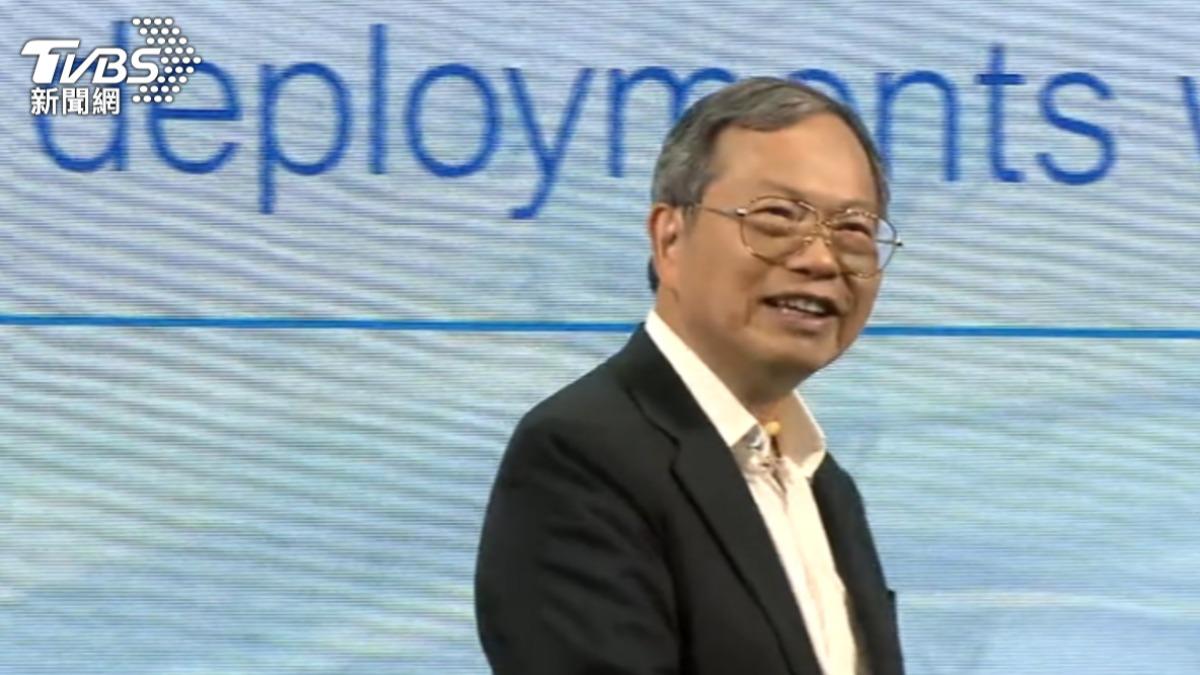

TAIPEI (TVBS News) — Super Micro Computer Inc.'s delay in filing its annual financial disclosures has significantly impacted Chairman Charles Liang's net worth. The California-based company's shares plunged 19% on Wednesday (Aug. 28), erasing more than US$800 million from Liang's fortune.

The company announced it needed additional time to assess internal controls, a day after short-seller Hindenburg Research released a report alleging "glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues."

Liang's net worth, almost entirely derived from his stake in Super Micro, fell to US$3.5 billion Wednesday from a March high of US$9 billion. Despite the recent drop, his net worth is still up by US$1.5 billion for the year.

Liang, 66, was born in Taiwan and completed an electrical engineering degree at the National Taipei University of Technology (Taipei Tech, 國立台北科技大學) before studying at the University of Texas at Arlington. He and his wife, Sara Liu, started Super Micro in 1993, initially producing server boards.

The company saw strong growth after shifting focus to high-efficiency power systems and components, with revenue rising from US$1.2 billion in 2013 to US$7.1 billion for the 2023 fiscal year.

Investors and analysts will closely watch Super Micro's next moves, especially as the company works to address the concerns raised by Hindenburg Research. The tech industry will also be keen to see how this situation unfolds and its potential impact on broader market trends.